The Maker Foundation Development Grants Program Sunsets

March 23, 2021

The MakerDAO project aims to unlock the power of the blockchain for everyone by creating an inclusive platform for economic empowerment — allowing equal access to the global financial marketplace. A fantastic way to bring this to life is to showcase Dai use cases from community members and partners.

Contributed article by Meridio

One of the most rewarding aspects of the Ethereum ecosystem is how collaborative projects are in the space. After all, these different projects and companies are deploying code to the same world computer. At Meridio, we are particularly fond of our collaboration with the Maker team. We integrated their DAI stablecoin into our platform early last summer in order to solve one of our most pronounced early challenges: investor apprehension to the volatility of Ether and Bitcoin. Now, investors on Meridio can seamlessly trade real estate shares for Dai, which allows a near-perfect approximation to the US Dollar while still gaining the benefits and efficiencies of smart contracts.

When Meridio’s co-founders Mo and Corbin began showing real estate investors our alpha product in early 2018, investors loved the idea of owning and trading fractional shares of real estate, but they shied away from using Ether or Bitcoin to transact due to the price volatility. Investors simply aren’t comfortable risking 5–10% of their investment each time they purchased or traded shares. Rather than reverting to traditional off-chain payment methods such as wire transfers, we began researching different stablecoins to use instead. A stablecoin allows for the benefits of smart contracts, including trustless trades and nearly instant settlement time, without the volatility of cryptocurrencies. We explored several stablecoin options, but ultimately chose to start with Dai due to the volume of user adoption, ease of implementation, and decentralized price control methodology.

To start, we integrated Dai in three areas of our platform:

Peer-to-peer trades of real estate tokens

Given investor’s overwhelming apprehension to the volatility of Ether and Bitcoin, our first priority was to make Dai the primary currency for any transactions of real estate shares. In our platform, each real estate property, fund, or REIT is represented by an Asset Token, which is an ERC-20 compatible smart contract with a customizable on-chain compliance layer. Traditionally, purchases of any ERC-20 token on-chain would require the buyer to make the purchase with Ether. Now, however, users can purchase or trade these Asset Tokens in our application directly with Dai in a trustless swap between the Asset Token and Dai. This means that the transaction can occur without the need for an escrow service and without being subject to any price volatility.

Conversion of ETH to DAI

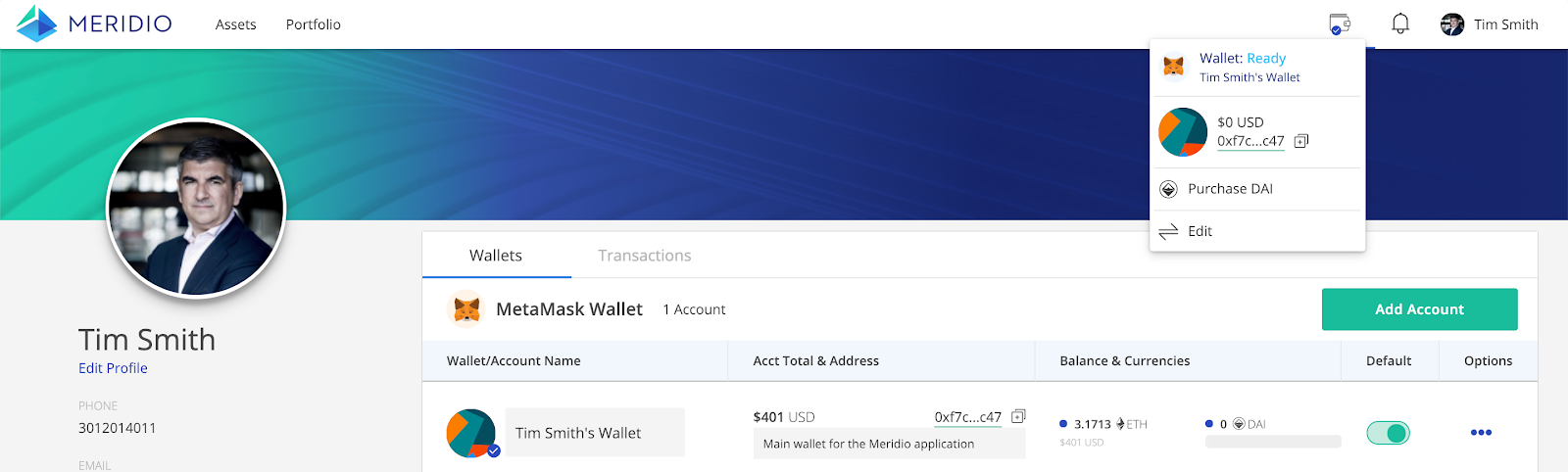

To provide seamless in-app support for investors that already hold Ether, we integrated Airswap’s widget in user wallets and profile pages so they can quickly convert any Ether they hold in Metamask into Dai. Thus, if a user chooses to hold ETH, they can simply convert their holdings to Dai in order to prepare for a trade with no counterparty risk, without leaving the platform, and without giving up custody.

Balances

On our wallet page, we provide each user with the Dai and ETH balance of their linked wallet so they can quickly see their current position and make any currency conversions accordingly. Additionally, on the portfolio page, we show users their Dai balance as “Cash Available” in USD to help drive the association between holding Dai and traditional fiat currency. Our goal is to abstract the blockchain experience from the user so they can feel comfortable trading real estate shares online, and Dai helps us bridge that gap.

We see peer-to-peer trades, Ether balance conversion, and balance displays as only the beginning of our collaboration with Maker. For example, real estate asset owners that issue digital shares on Meridio could also distribute dividend payments using Dai based on real-time trading data, rather than manually issuing thousands of wire-transfers based on backward-looking data each quarter. Moreover, if these dividend payments are recorded on-chain, end-of-year accounting, tax, and K1 issuance can be completely automated using tools like Balanc3. These instant, seamless, and documented payments on-chain are further eased by services like Wyre that are rolling out fiat on and off-ramps (USD⇔DAI).

The Maker team has many ambitious upgrades planned, notably support for a variety of digital assets in CDPs, known as Multi-Collateral Dai. We imagine a future where real estate tokens could be used as collateral for issuing Dai loans, given that real estate is a historically more stable asset than cryptocurrency or equities.

Ethereum provides a common platform for combining together many different, complementary projects, and you’re starting to see the movement accelerate especially within the DeFi community. We’re proud to do our small part introducing Maker to the world and are grateful to be a part of their journey.

The building blocks for a more open and innovative financial system are starting to emerge, and the sum is certainly greater than all the parts. If you’d like early access to the Meridio platform or would participate in user testing, please sign up here!

Thanks to Dave Conroy, Parker Place, Asha Dakshi, Jon Sanders, Connor O’Day, and Corbin Page for helping put together this post.