How New Blockchain Apps Make It Easier To Use DeFi

June 25, 2021

After months of development, we’re excited to share some big updates on two Oasis products: OasisDEX and OasisDirect.

For those who are not yet familiar, Oasis is a simple on-chain market for all token assets in the Maker registry. It serves as a liquidity pool on the Ethereum blockchain which is useful for large transactions. The Simple Market and Matching Market smart contracts behind Oasis provide for the trustless exchange of ERC20 tokens without counter-party risk. All trades are peer-to-peer and both the orderbook and settlement are on-chain; making it easy for users to verify their transactions.

OasisDex provides a convenient user interface to the Oasis smart contracts for traders who want to make or take Limit Orders by setting manual buy/sell limits, whereas OasisDirect provides a simple user interface that suggests the trade price based on the order volume and the current order book depth, making the trade a “one-click” experience for the user.

We built OasisDirect to make it fast and easy for users to acquire tokens like DAI, MKR and more. It’s a fully decentralized and an instant trading platform that anyone can use. Users can exchange Ether for tokens without creating an account or paying exchange fees.

For the past few months we’ve focused on building a better product, with a particular emphasis ensuring a seamless user experience. We have some big improvements to share with OasisDirect that make it faster and easier to use.

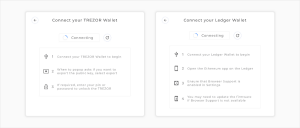

We are especially proud to share our first announcement: OasisDirect now supports Ledger and Trezor hardware wallets.

This is a particularly big step for our users as it’s best practice to use a hardware wallet for safely storing your digital assets. Hardware wallets achieve a good balance between safety and functionality. All the operations and transactions are executed on the device and private keys are never exposed to your computer, making it a safer option for holding your crypto assets.

We’ve simplified the transaction process by bundling multiple transactions into a single call through the use of a proxy contract. This makes it much easier to do multi-step trading operations on Oasis.

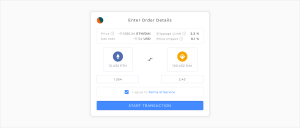

OasisDirect estimates the trade price based on the order volume and current order book depth at OasisDex.

For example, assume there are three standing orders on the ETH:DAI order book, each with sell offers of 10 ETH for 5000, 5100 and 5200 DAI respectively. If a user wanted to buy 5 ETH, the estimated trade price will be 500 ETH:DAI (half of the first sell order will be filled). However if the user wanted to buy 20 ETH, the estimated trade price will be 505 ETH:DAI (two sell orders will be filled so ultimately 20 ETH will be bought for 1010 DAI).

With the introduction of Price Impact, users that fill multiple orders at once, each of which is a different price, will see how the estimated trade price differs from the current best order on the order book.

Price Impact is an additional indicator to the slippage limit that was available in the previous version of OasisDirect, which specified the maximum difference between the estimated trade price and the actual trade price (these two may differ as the order book is dynamic and can change between estimation and the execution of the trade). Slippage limit ensures that the actual trade price does not differ substantially from the estimated trade price that was accepted by the user. If the order book changed significantly between estimating the price and the trade execution the order will not be filled. This essentially makes orders on OasisDirect fill-or-kill Limit Orders with the price limit set 2% above the accepted estimated trade price.

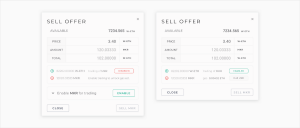

We’ve updated the interface so that quote currencies are consistently displayed throughout the application, regardless of whether you sell or buy a token. DAI is the default quote currency, with ETH as second option for non-DAI pairs.

For most exchanges and interfaces, gas prices are denominated in ETH. However, as both the price of ethereum and gas fluctuate, it can be annoying to estimate how much you’re paying for a transaction.

We’ve made it simple for users by displaying gas price in USD so they understand exactly how much the transaction will cost.

The goal has always been to deliver sleek and intuitive trading interfaces, delivering access to liquidity with low spreads, without additional fees or sign-ups and other complicated processes.

We have a few major improvements and developments to share:

We did a complete code rewrite from Meteor.js to React/Redux. With cleaner code and improved modularity, it will be easier to introduce additional functionality in the future. This was critical to supporting upcoming major enhancements such as margin trading, new order types, integration with a decentralized caching layer, and more. The current code base also makes user experience much smoother as more data is cached in memory, making the user interface far more responsive.

We now support binary allowance on OasisDEX, which means you can enable trading on a token in your account in whatever quantity you choose. This should reduce unnecessary gas fees and will not require users to specify arbitrary limits on token allowances.

For example, you may approve the contract to take 100 WETH from your account, but it’s inconvenient, since once 100 WETH is taken, you need to set that allowance again and pay gas fees.

These latest developments make the platform faster, safer and more intuitive and overall, enable a better OasisDex and OasisDirect experience for our community. We are committed to providing building great products and tools to provide a better ecosystem for users. Stay tuned for more as we have an exciting road ahead filled with big milestones!

We believe in a future that leverages the power of decentralization for trustless transactions.