How New Blockchain Apps Make It Easier To Use DeFi

June 25, 2021

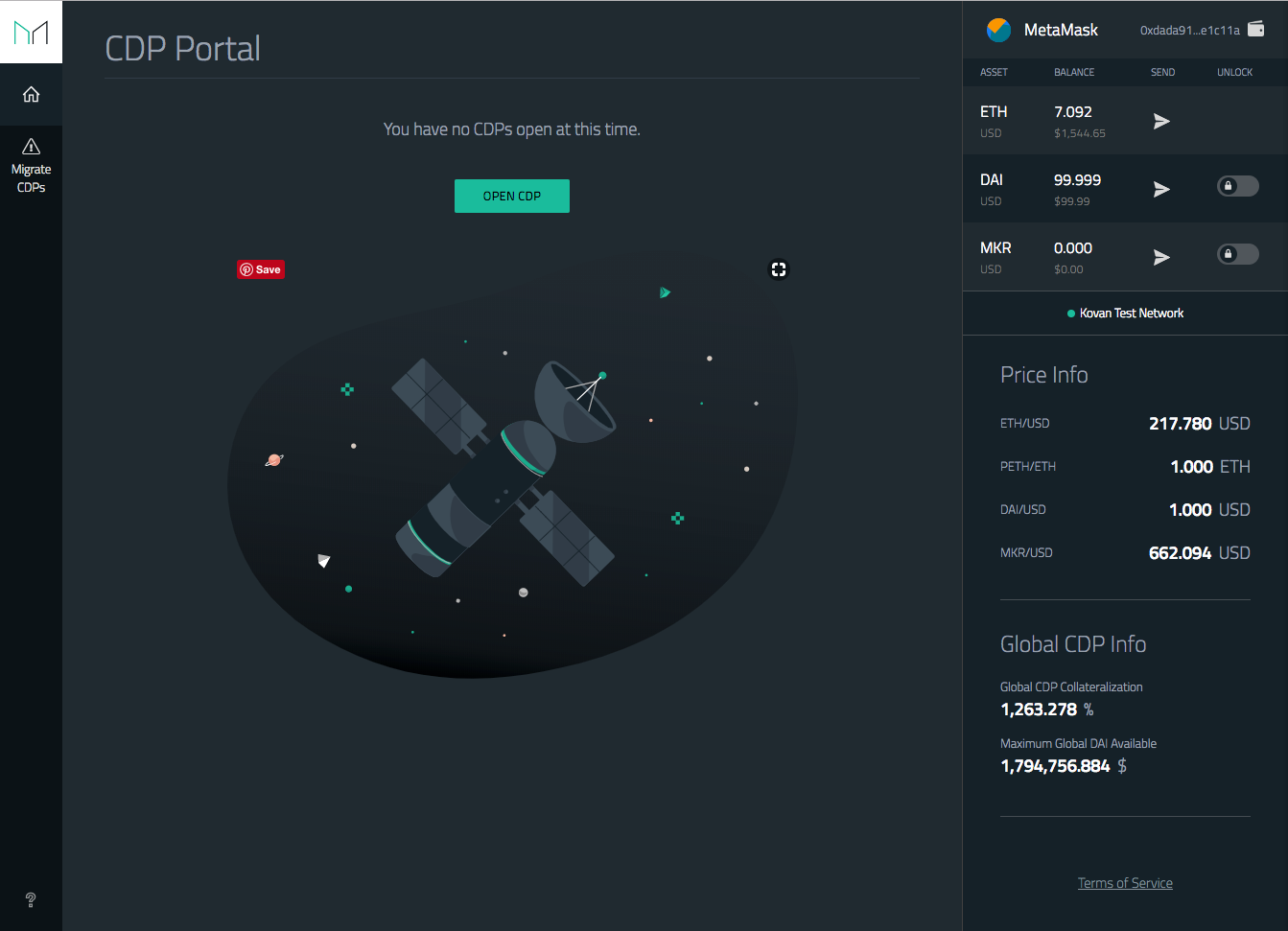

We’re pleased to announce the release of the new CDP Portal for single collateral Dai which can be found at cdp.makerdao.com.

The CDP Portal is the new dapp where you can interact with the permissionless smart contracts constituting the Dai Credit System, such as opening and managing your CDPs, similar to that of dai.makerdao.com but with a focus on user experience. Opening a CDP allows you to generate DAI against your collateral. The collateral is locked up in a smart contract until you repay your outstanding DAI balance and a stability fee — assuming that your CDP is properly managed against the risk of collateral volatility¹.

Over the last few months, we have worked tirelessly to understand how we can make it easier and more intuitive for users opening and managing CDPs. Through multiple rounds of user testing, design iteration and the creation of new proxy contracts, we now have a version we are proud to share with the community. Also, note that this is just a frontend to the smart contracts-based system and we encourage creation of alternative frontends.

One of the biggest changes to the original Dai Dashboard is the introduction of a proxy contract. This proxy contract enables users to carry out multiple transactions in one, such as opening a CDP, locking collateral and generating Dai all within a single atomic transaction. This means no more approving ‘Token Allowances’ before you need to begin and no more wrapping ETH before being able to lock it. You can find the code linked to the proxy contract here and here.

The second major change is to the UI. At MakerDAO, in addition to writing secure smart contracts, we aim to create intuitive interfaces that make it easy to interact with the Dai Credit System.

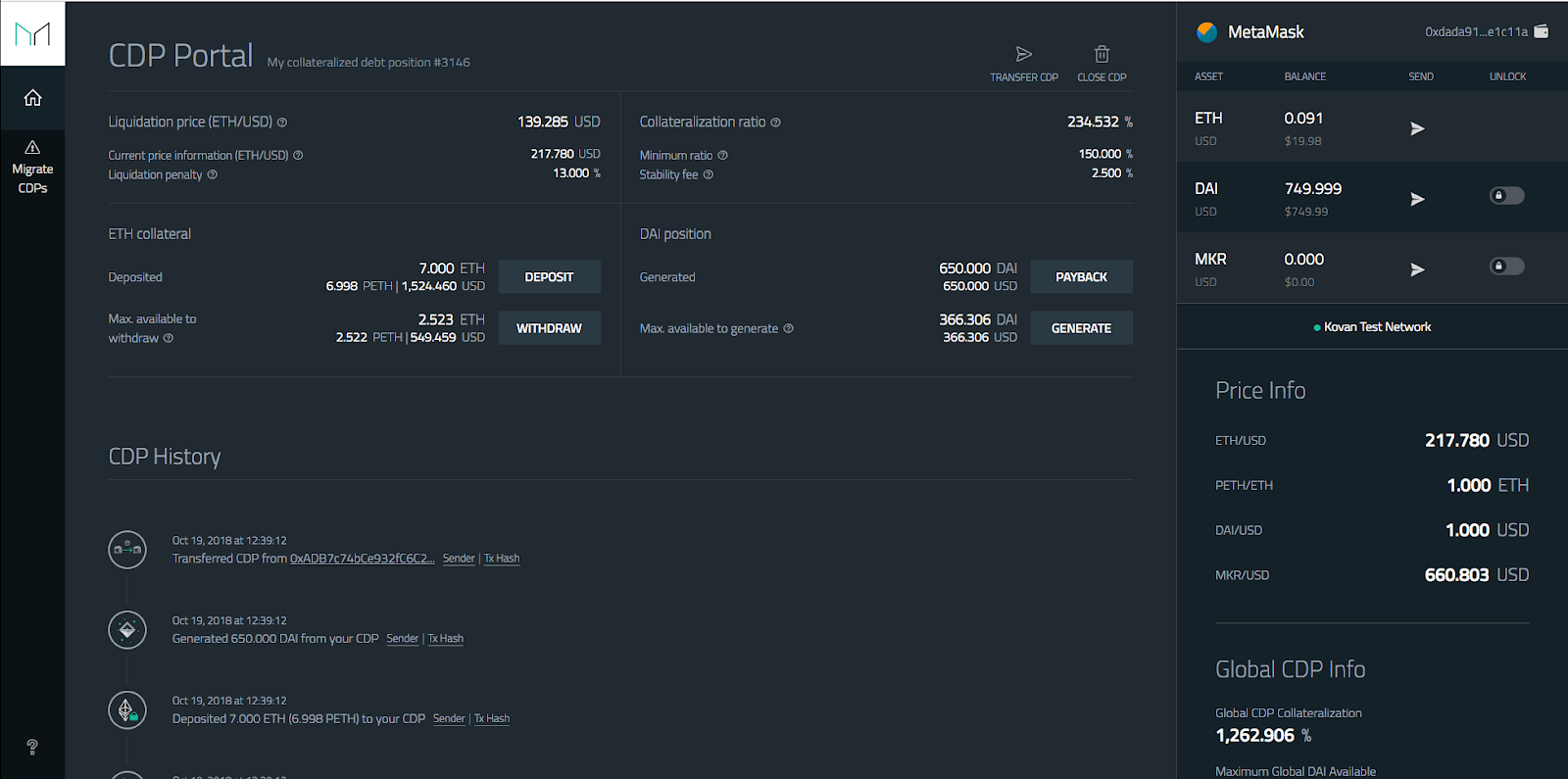

Opening a CDP is now an easy two step process, simply enter how much ETH you wish to collateralize, and how much DAI you want to generate — the UI will give you helpful figures detailing the liquidation price and collateralization ratio. If you’re generating DAI which is within a particularly unsafe (<200%) range, you will see warnings before being able to continue, and likewise if in the liquidation range (<150%) you will not be able to open a CDP.

The second step is to confirm your CDP and accept the Terms of Service before your CDP is opened.

Once you’ve a opened a CDP, your dashboard will display the critical details and all the actions you can take in order to manage your CDP including Deposit, Withdraw, Payback, Generate Dai and Close your CDP. You will also be able to see the history of your CDP and all the actions you have taken.

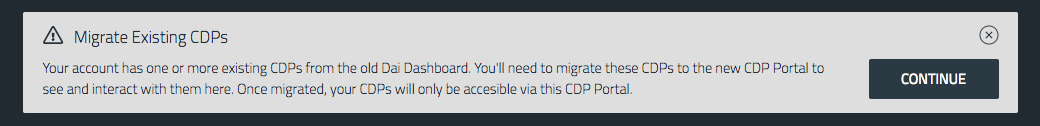

If you have an existing CDP you will need to migrate it into a new proxy contract in order to view and interact with it in the CDP Portal. When you go to the new CDP Portal and connect the wallet holding your existing CDP(s), you will see an alert to migrate them and an option on the left sidebar. Clicking through to the migration screen will allow you to migrate any of your existing CDPs. Please be aware that any CDPs you migrate will no longer be accessible through the classic Dai Dashboard.

We are pleased to announce that users now have the option to create and manage their CDPs using Ledger Nano S and Trezor hardware wallets. The CDP Portal will continue to support all major web3 clients like Metamask. You will be asked to select a wallet each time you visit cdp.makerdao.com.

Creating great products requires constant user feedback and design iteration. We are launching the CDP Portal for Single Collateral Dai in order to learn as much as we can from our users, and use that knowledge to release an improved version of the CDP Portal for Multi-Collateral Dai. If you have any thoughts, feedback, questions or concerns, please let us know via our product-feedback channel on RocketChat or Reddit. We’d love to hear from you.

LEGAL DESCLAIMER

¹This is a simplified overview on how Maker’s CDP in single collateral dai functions. For more in-depth information on CDPs, and especially risks involved, please see our white paper, located at Makerdao.com/whitepaper, as well as the Terms of Service, incorporated herein by reference.