How New Blockchain Apps Make It Easier To Use DeFi

June 25, 2021

Multi-Collateral Dai (MCD) will be released on November 18, and along with its new features will come a very important change in terminology: “Collateralized Debt Position (CDP)” will be replaced with “Vault.”

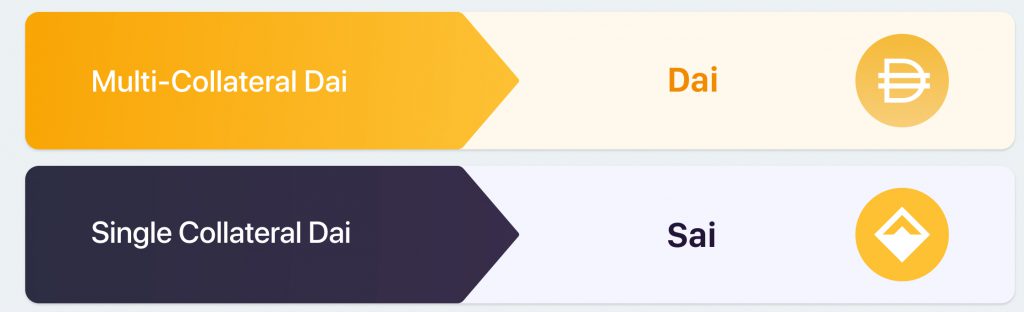

Additionally, to help users and others distinguish between Dai generated via SCD and Dai generated via MCD, we will begin referring to SCD-generated Dai as Sai, and MCD-generated Dai as Dai. We urge all in the Maker community and in the media to do the same. While this isn’t a terminology change, it is a key point of awareness around preferred language.

As we in the Maker Foundation work to bootstrap MakerDAO, we don’t make decisions like these lightly.

Why Make Terminology Change?

The launch of Multi-Collateral Dai will introduce new types of collateral and more Dai into circulation, and will welcome new groups of users. As the upgrade from Single-Collateral Dai (SCD) to MCD was planned, we saw a good opportunity to review how current terminology might or might not be understood by a larger audience, many of them newcomers to the Maker Protocol.

One term that came up for review immediately is Collateralized Debt Position (CDP). After speaking with a number of users, we learned that some find the word “collateralized” confusing because it makes them think of traditional financial products that have nothing to do with what a CDP offers. Additionally, because MCD will allow different types of assets as collateral, some people are already using the term “CDP” to mean everything a user holds in the Maker Protocol, while others are using it to mean each type of collateral deposited.

Therefore, to reduce the chance of confusion moving forward, we have created a new term: Vault.

The Maker Vault in MCD is where a user deposits collateral and generates Dai. Importantly, each collateral asset deposited will have its own Vault. To help you gain a solid understanding, consider how the word is used in two scenarios:

Scenario one: Bob wishes to generate Dai using ETH as collateral in the Maker Protocol. To do so, Bob deposits ETH into a Vault. Each collateral type will have its own Vault, so Bob will likely have an ETH Vault, a BAT Vault, and a Vault for each additional collateral type he uses to generate Dai. He might also have Vaults with different levels of collateralization.

Scenario two: Alice wishes to withdraw all the BAT collateral in her Vault. To do so, she must pay back the amount of Dai she generated earlier, as well as the accrued Stability Fee. Once Alice receives her collateral, the system does not “close" her Vault. Instead, the Vault remains on the blockchain empty until she chooses to make another deposit.

Moving With the Change

The new terminology will be reflected within the user interfaces of Maker Protocol immediately upon the release of MCD, as well as in any new documentation published from now on. Existing documentation, of which there is quite a bit, will be changed over time to include the new verbiage.

For the Dai.js SDK and similar tools, there are no plans to change actual function names that contain “CDP.” However, the documentation for Dai.js will be updated.

Finally, and importantly, for the current Single-Collateral Dai (Sai) deployment, no changes will be made to terminology. The CDP Portal frontend and the documentation associated with SCD will still refer to CDPs.

Next Steps for Users

Users do not have to take action except to simply remember that, when MCD launches, if you are used to depositing collateral in a CDP to generate Dai, you will instead deposit collateral in a Vault from which Dai will be generated.

Please join us in our mission to shape the future of commerce on the blockchain. To learn more about MCD, read our MCD-related blog posts. To learn more about MakerDAO, join the conversation on the Maker Forum.