How New Blockchain Apps Make It Easier To Use DeFi

June 25, 2021

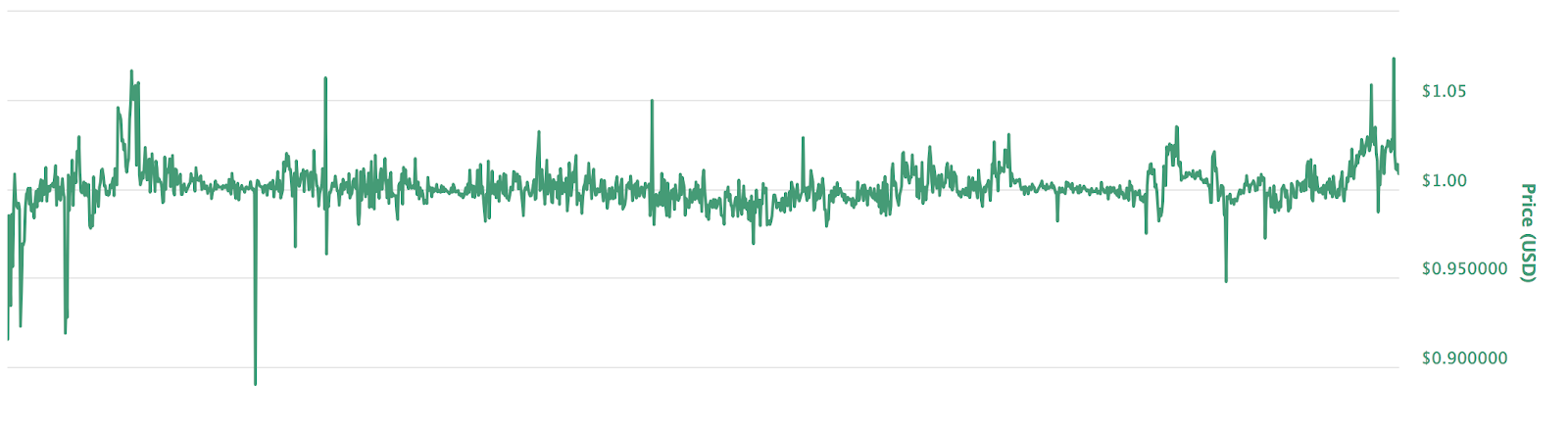

2018 has been quite a year for crypto, with intense fluctuation of cryptocurrency prices and a dramatic drop in the price of ETH. Despite the ups-and-downs, we’re proud to share that Dai has maintained it’s peg and stayed stable throughout the considerable drop in ETH price from $1400 to below $100.

From January to the end of the year, Dai has been a safe haven for those who sought shelter from the volatility of this aggressive bear market. Users locked away a record-breaking amount of ETH through CDP smart contracts to produce Dai.

Opening a CDP meant that users could achieve protection from the price fluctuation of the market, all while still maintaining their original ETH, something that many took advantage of. This means you don’t have to take your ETH off the table, in order to get leverage or protect your assets. Of course, the CDP system still comes with risks as individuals are responsible for managing their CDPs and understanding the possibility of liquidation.

You can easily create a CDP in our CDP portal. To open a CDP, you simply enter how much ETH you wish to collateralize, and how much Dai you want to generate — the CDP Portal UI will give you helpful figures detailing the liquidation price and collateralization ratio.

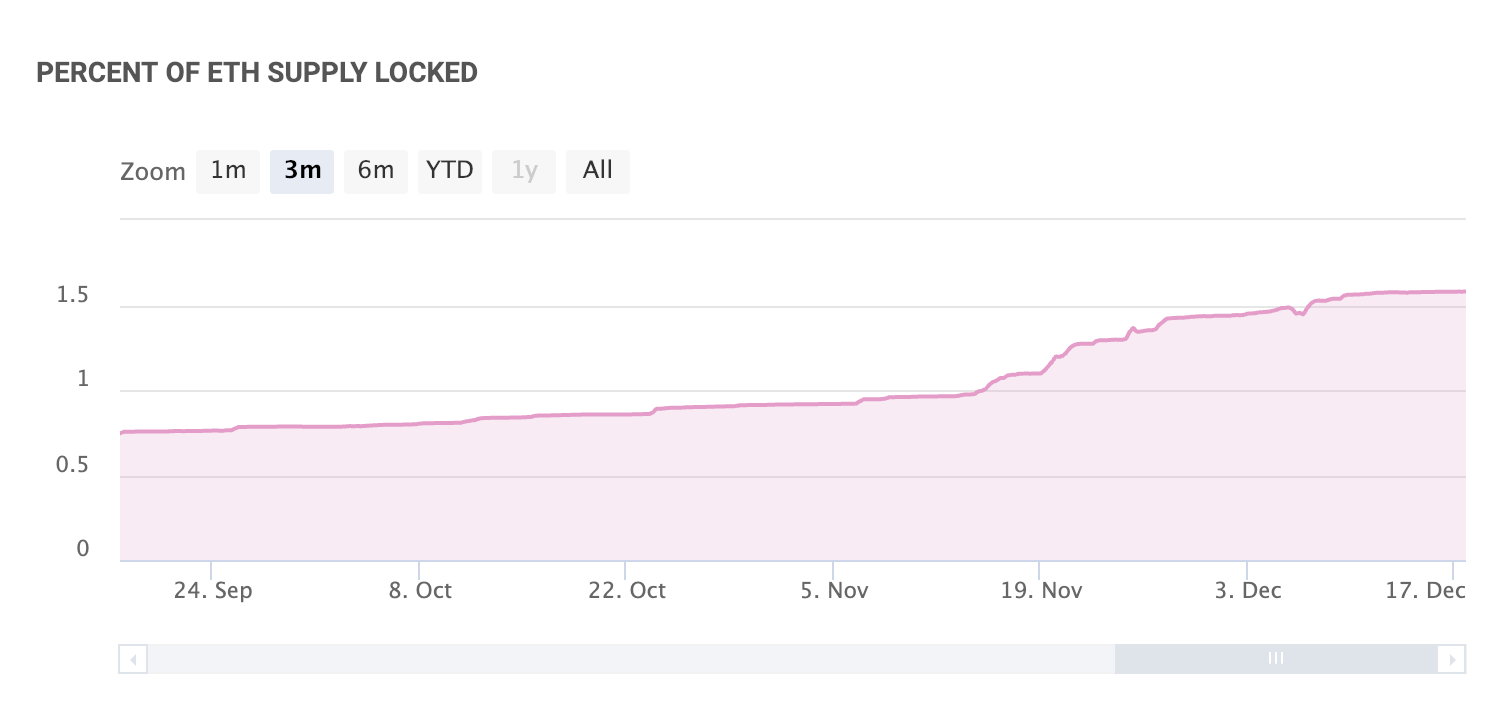

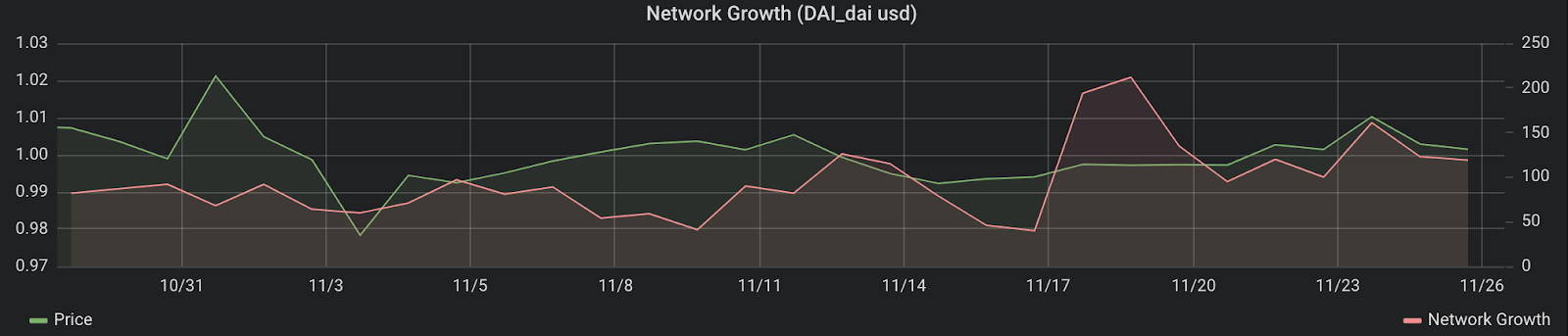

In particular, from Nov 13 to Nov 19th the price of ETH dropped significantly and as seen in the charts below, a record number of people were looking for a port in the storm. In fact, by mid-November, nearly 1% of the total circulating supply of ETH was locked up in MakerDAO smart contracts. Today, over 1.6 Million ETH is locked up in CDPs, accounting for over 1.5% of the 103,219,284 ETH in circulating supply.

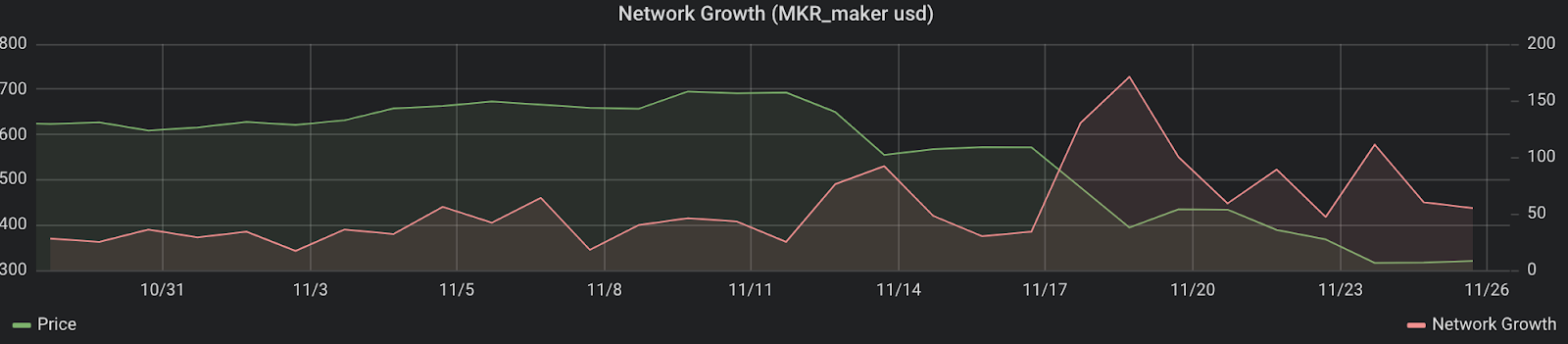

In the charts below, you can see large amounts of Dai created, total ETH locked up and the increase in MKR network activity, all correlating with the ETH price drop.

Naturally, this also corresponded with a big increase in new addresses created for MKR.

This was a remarkable display of stability in times of sudden price fluctuation of collateral. Keepers effectively participated in collateral sales to maintain the solvency of Dai and ensure the orderly wind-down of liquidated CDPs.To learn more about the Maker Ecosystem, please see this primer on Dai.

We believe in a future that leverages the power of decentralization for trustless transactions.

With Maker, we are carrying out our vision of creating a decentralized stablecoin that will unlock the unique benefits of a complete financial ecosystem on the blockchain. Join us!

Read our Whitepaper