How New Blockchain Apps Make It Easier To Use DeFi

June 25, 2021

Public blockchains, including the two most popular—Ethereum and Bitcoin—are digital ledgers visible to all. But while all on-chain data is transparent, a blockchain’s infrastructure serves a self-contained ecosystem. By design, blockchains are siloed, and for good reason: To maintain the consensus that underpins the security and accuracy of a shared ledger, only miners who meticulously follow the rules of each network are allowed to verify and write transactions to the blockchain.

The system is incredibly effective, but the siloed nature of blockchains is arguably stunting DeFi progress, locking DeFi users into a single network when the blockchain space as a whole offers a world of functionality and opportunities. At a time when the Lego-like composability of decentralized finance applications (dapps) is changing the face of financial services, it’s more important than ever for independent blockchains to “communicate” with another.

While comprehensive cross-chain infrastructure solutions, such as Polkadot, Cosmos, and Avalanche, are gaining popularity, many users simply want to move digital assets from one chain to another and use dapps and other services more efficiently.

Enter blockchain bridges.

Blockchain bridges enable interoperability between vastly different networks, such as Bitcoin and Ethereum, and between one parent blockchain and its child chain, called a sidechain, which either operates under different consensus rules or inherits its security from the parent blockchain (e.g., rollups built on Ethereum).

While some blockchain bridges are centralized, others preserve the all-important decentralization that helps ensure the security and openness of DeFi protocols.

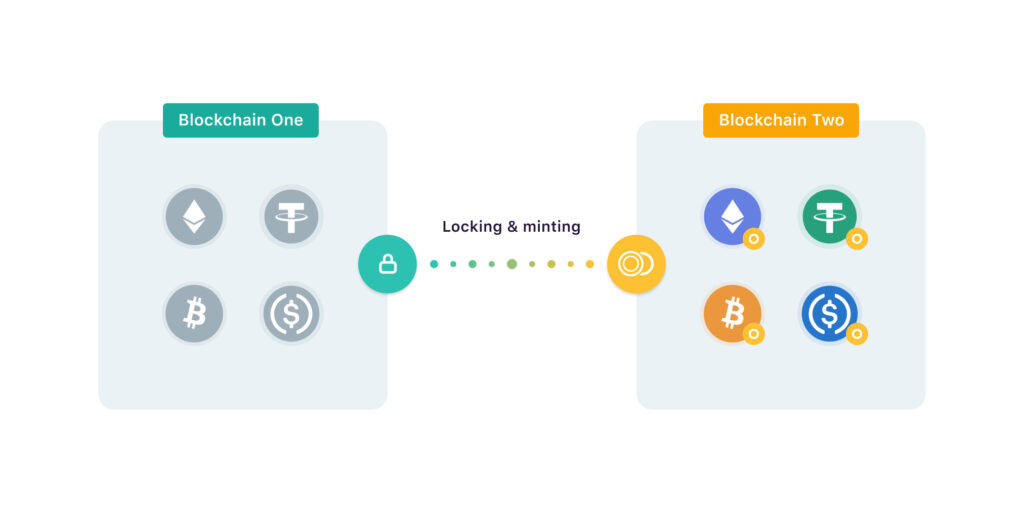

When a user transfers assets from one blockchain to another using a decentralized bridge, those assets are not literally relocated or “sent” anywhere. Instead, functionality is leveraged through a two-stage process. First, the assets are locked or “frozen” on the blockchain where they live using a smart contract or, if smart contracts are not supported, another mechanism.

Let’s look at the Ren Protocol,

This approach allows users to “move” any digital asset (potentially) from one blockchain to another without third-party assistance. RenVM currently empowers anyone to use BTC, BCH, ZEC, and DOGE tokens on Ethereum and Binance Smart Chain.

More popular than any decentralized blockchain bridge is a centralized initiative that enables Bitcoin (BTC) users to leverage the benefits of Ethereum: Wrapped Bitcoin (wBTC). Users deposit X amount of Bitcoin via partners called “merchants” into a wallet controlled by a trusted (centralized) custodian, institutional digital asset company BitGo, which stores the BTC securely and then mints wBTC tokens of equal value on Ethereum. Because all wBTC are backed 1:1 by BTC, the two tokens are roughly equivalent in value. Also, and most importantly, since wBTC is an ERC20 token, it, unlike Bitcoin, can be used as collateral in popular Ethereum dapps, such as Uniswap, Compound, Aave, and the Maker Protocol.

Wrapped Bitcoin and similar projects, such as imBTC and HBTC, each provide a simple and effective solution to the problem of moving value across siloed blockchains.

Unlike a bridge that links two completely different blockchains, a sidechain bridge connects a parent blockchain to its child. Because the parent and child operate under different consensus rules, communication between them requires a bridge.

For example, the developers of the popular blockchain game Axie Infinity created a dedicated Ethereum-linked sidechain called Ronin to allow the game to scale beyond what was possible on the Ethereum mainnet.

Another popular example is xDai, also an Ethereum-based sidechain.

Sidechains will also play a key role in scaling the network ahead of Ethereum 2.0 through the use of rollups, a means of bundling many sidechain transactions into a single transaction secured on the main chain. Ethereum co-founder Vitalik Buterin recently stated this approach can potentially increase transaction throughput by 100 times in the coming months.

Interoperability between blockchains—including between a main chain and a sidechain—allows users to access the benefits of each without sacrificing the advantages of the host chain. This has several implications and use cases:

Blockchain bridges enable users to access the benefits of different blockchain technologies without having to choose between platforms. This not only helps take pressure off of Ethereum, the most popular DeFi network, but also invites innovation in other ecosystems without necessitating a winner-takes-all mentality.

To stay updated on key developments in the DeFi space, follow the MakerDAO blog.