How New Blockchain Apps Make It Easier To Use DeFi

June 25, 2021

The release of Multi-Collateral Dai (MCD) is only 10 days away and will mark a huge milestone reached for the MakerDAO project. MCD will introduce exciting new features to the Maker Protocol, including the much-anticipated Dai Savings Rate (DSR) and, of course, additional collateral asset types. But, while those features are among the most discussed in the global Maker community and the crypto world at large, there’s much more to look forward to and prepare for on the day of launch.

We’ve published a lot of MCD-related material over the past few months—so much that it’s worth recapping the most important to best prepare users for the upgrade from Sai to Dai, new terminology, new products, new content, and a new look online.

New Terminology

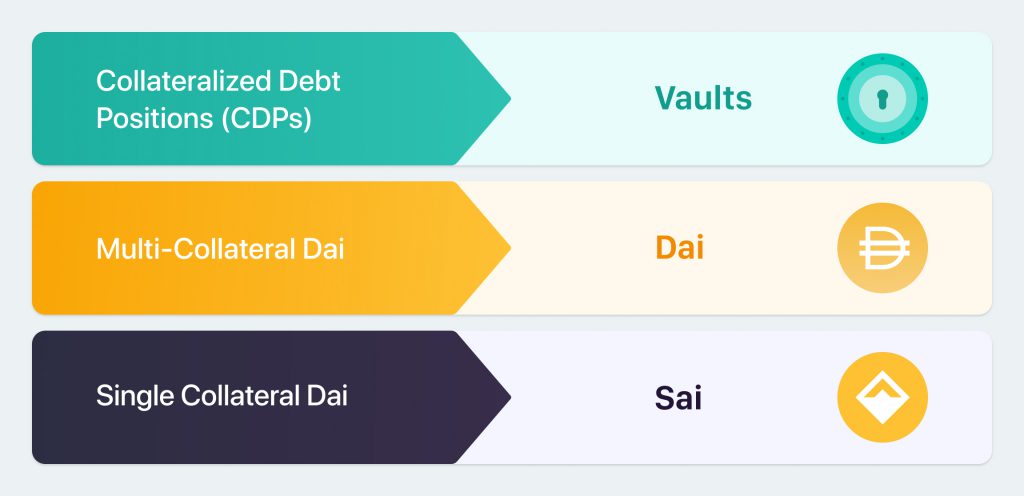

Late last month, we announced a very important change in terminology: “Collateralized Debt Position (CDP)” will be replaced with “Vault.” We also asked members of the Maker community and the media to begin referring to existing Dai (Single-Collateral Dai) as Sai, and MCD-generated Dai as Dai. This will help everyone distinguish the difference between the two and become more accustomed to the preferred language.

The new terminology will be reflected within the user interfaces of Maker Protocol immediately upon the release of MCD, as well as in any new documentation published from now on.

New Dai

On MCD launch day, anyone, anywhere will immediately be able to upgrade their Sai to Dai easily through the Migration app (more on migration below).

Upgrading provides users with all of the benefits of MCD, including more collateral options and the Dai Savings Rate.

Multi-Collateral Dai represents the future of digital money, with the realization of the Maker Foundation’s and the community’s goal of more active governance. Accordingly, Maker Governance will concentrate on MCD-related proposals and votes weekly, reducing its focus on SCD. Therefore, anyone looking to take advantage of all of MCD’s many developments should upgrade to Dai as soon as possible.

Multi-Collateral Dai

The extensibility of the Maker Protocol means that, with MKR voter approval, almost any tokenized asset that has appropriate risk parameters could be made available as collateral in the system.

The Maker community is currently evaluating seven cryptocurrencies, including prediction market Augur’s REP token and digital advertising platform Brave’s BAT token. Of the seven tokens, the first two being evaluated by the interim risk team for inclusion in MCD are BAT and ETH.

Further, the current Single-Collateral Dai system requires Stability Fees to be paid in MKR, the Maker Protocol’s governance token. In the MCD system, Vault owners pay Stability Fees in Dai.

Dai Savings Rate

The Dai Savings Rate (DSR), a highly anticipated feature of MCD, will allow Dai holders to earn savings natively, further differentiating Dai from other stablecoins.

The DSR will:

As we reminded readers in our last update on the DSR, any Dai holder will be able to lock Dai in a smart contract to earn additional Dai. Moreover, Dai holders will be able to deposit and withdraw Dai via a simple-to-use dapp provided by the Maker Foundation.

The initial DSR will soon be debated and voted upon by MKR holders. As presented in the November 4 Migration Risk Construct Proposal, authored by Cyrus Younessi, Risk Management Lead at the Maker Foundation, “Given the absence of any empirical data, it is difficult to select a precise starting DSR value. However, a DSR of 2% is likely to be competitive with the broader DeFi ecosystem, which currently offers a ~6% (and dropping) savings rate on Sai.”

A blog post that details the many interesting aspects of DSR will be published in the days ahead.

Migration

Users can migrate their Sai to Dai upon MCD launch. Plenty of your favorite exchanges and partners will be ready. But remember, the opportunity to migrate isn’t open-ended. At some point in the future, when the community has determined that it is no longer possible to effectively manage the Sai ecosystem, or desirable to do so, Emergency Shutdown will be triggered in SCD. We can't predict when this will happen. Therefore, users should migrate sooner rather than later to avoid global settlement. To learn what happens to Sai and CDPs that are not upgraded, review the documentation on Emergency Shutdown.

All types of users, from Sai and CDP holders to Keepers and dapp developers, can reference the Migration Guide for assistance with the upgrade. Importantly, the guide also reminds users that they must pay the Stability Fee in MKR in order to close a CDP. That means users must have MKR in their wallets to complete the migration to MCD.

Governance Polls and Executive Votes

The Maker Protocol is managed by those around the world who hold its governance token, MKR. Through a system of scientific governance involving executive polling and voting, MKR holders manage the Maker Protocol and the financial risks of Dai to ensure its stability, transparency, and efficiency. One MKR token locked in a voting contract equals one vote.

Now through the end of the year, the Maker community should expect more governance calls, polls, and executive votes. The Maker Foundation will alert the community to such actions as necessary. Starting in January, the governance/risk cycle will likely become more predictable, with discussions, polling, and voting centered around collateral additions, formal risk models, asset priority polls, and the DSR.

New Oasis

On October 2, we launched Oasis Trade, taking the first step toward creating an all-in-one decentralized finance (DeFi) hub. On November 18, with the release of MCD, we take the next step—the launch of two new products: Oasis Borrow and Oasis Save:

Oasis Borrow is the portal users will access to lock their collateral assets (ETH and BAT at launch) in Vaults and generate Dai.

Oasis Save is the product that will enable the Dai Savings Rate mechanism in MCD, which will allow users to earn savings on Dai.

Importantly, immediately upon launch of MCD, Oasis Trade will cease trading Sai, and begin trading Dai. Users will be able to cancel their standing Sai orders and migrate their Sai tokens to Dai in order to resume trading on Dai markets.

A blog post that details the Borrow and Save products will be published next week.

New Exchange Options: Anticipating Multi-Collateral Dai on Exchanges

We are working with exchanges that are preparing to offer MCD; however, they are on their own timelines. We expect to see rollouts on most exchanges in 1-3 weeks, but users should contact their exchanges if they have any questions and take advantage of Oasis Trade in the meantime. We will also publish a blog post that will contain a tracker showing the exchanges that support MCD.

Documentation On Auctions, Keepers, and Oracles

In July, to help everyone in the Maker community better understand MCD system operations, we published our Introduction to Auctions and Keepers in Multi-Collateral Dai. Whether you participate in the governance of the Maker Protocol or you’re a Dai user that depends on the stability of the system, you might want to understand how Auctions work and what role they and Keepers play in maintaining system balance.

A few months later, we published related materials: Introducing Oracles V2 and DeFi Feeds (Sept. 3) and How to Run Your Own Auction Keeper Bot in MCD (Sept. 4).

The first set of organizations running Feeds in Oracles V2.

Today, we announce an Oracle Security Module (OSM) in MCD, between the system and every Oracle. This OSM will delay a price for one hour, allowing Emergency Oracles or a governance vote to freeze an Oracle if it is compromised. Decisions regarding Emergency Oracles and the price delay duration are made by MKR holders.

New Branding, Web Design, and UX

After undertaking a months-long internal brand audit and talking to community members, we saw an opportunity to evolve Maker and Dai branding, including the design of our website, to improve the ways in which users experience our platforms. These changes, which will help move DeFi into the mainstream and assist Dai in being globally recognized as a currency, will be explained in an upcoming blog post.

New Content

New White Paper. In December 2017, MakerDAO published its original white paper, which introduced the Single-Collateral Dai system. Shortly after the launch of MCD, a new white paper will be published and will provide a technical description of the full design of the Multi-Collateral Dai system.

Developer Guides. Developers can and do build a variety of dapps on top of the Maker Protocol. Our developer’s repository contains guides and tutorials to help them understand how to interface with MakerDAO and our partners through smart contracts, SDKs, APIs, and products.

A Focus on Thought-Leadership. Website visitors, specifically readers of the Maker blog, can expect an increase in thought-leadership content and more variety in the types of informational and educational posts published.

More FAQs. Our FAQs page will be more robust moving forward, offering FAQs for partners, Vault owners, Dai holders, and newcomers.

An Increase in Translation Efforts. Our blog is currently published in English, Spanish, Japanese, Chinese, and Korean. Before the end of the year, we will also begin translating product portals our most important documentation, including white papers. Users can expect website localization to begin immediately and be completed by December.

We Are Here to Help!

To recap, the goal of this post is to help prepare you for the release of Multi-Collateral Dai. If you have any questions about the launch of MCD or the upgrade from Sai to Dai, reach out to us anytime on the Maker Forum.